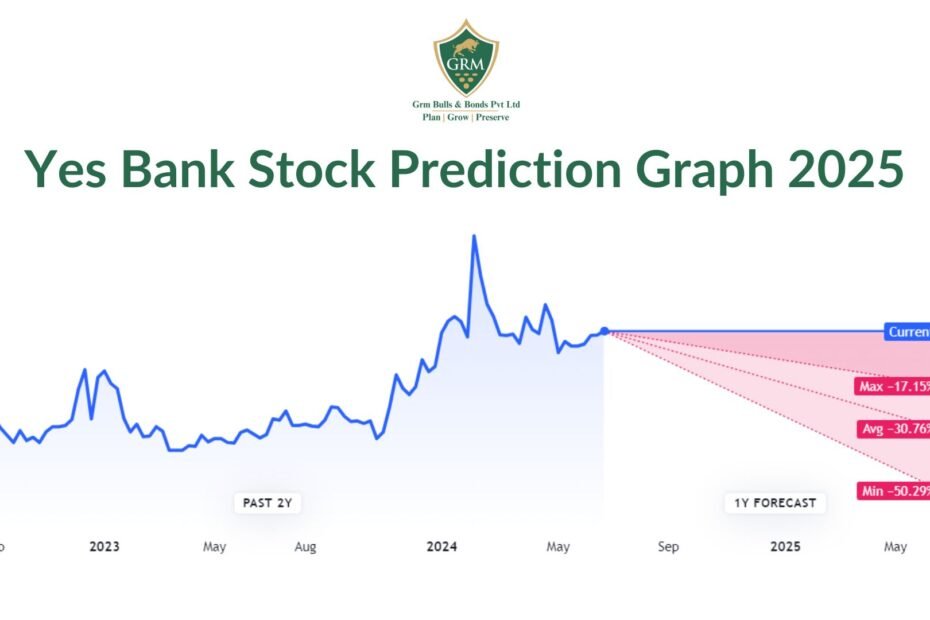

Yes Bank’s stock prediction for 2025 shows a promising upward trend, with targets ranging from Rs. 21.09 to Rs. 27.42, indicating strong growth potential through 2030.

Headquartered in Mumbai, Yes Bank is the seventh-largest private sector bank in India with a market capitalization of INR 69,319 crore. Founded in 2004 by Mr. Ashok Kumar and Mr. Rana Kapoor, Yes Bank provides services across the Retail, MSME, and Corporate Banking sectors, operating in 700 cities with 1,192 branches and 13,021 ATMs. However, due to issues with asset quality, capital, and financial stability, the RBI took over Yes Bank in March 2020, selling it to a consortium of banks. This significantly impacted Yes Bank’s share price, which has fluctuated between Rs 15.90 and 26.25 in the past six months.

Latest Financial Results of Yes Bank

Understanding Yes Bank’s latest financial results is crucial for making an informed investment decision. Here are some key highlights from Q2 FY24:

- Net Profit: Increased to Rs. 225.21 crores, a surge of 47.4%.

- Gross NPA Ratio: Stands at 2%.

- Non-Interest Income: Rose by 38.4% YOY, amounting to Rs. 1,210 crores.

- Net Interest Income: Increased by 3.3% to Rs. 1,925 crores.

- Total Interest Income: Reached Rs. 4,785.61 crores, up from Rs. 3,483.02 crores in Q2 FY23.

These financial results indicate a positive trend for Yes Bank, suggesting potential growth in its stock price.

Yes Bank Stock Prediction 2025: Monthly Targets

Yes Bank Share Price Target for 2024

| Month | Maximum Target | Minimum Target |

|---|---|---|

| January | Rs. 19.67 | Rs. 17.10 |

| February | Rs. 20.07 | Rs. 17.45 |

| March | Rs. 20.48 | Rs. 17.81 |

| April | Rs. 19.88 | Rs. 17.29 |

| May | Rs. 19.59 | Rs. 17.03 |

| June | Rs. 20.29 | Rs. 17.64 |

| July | Rs. 20.09 | Rs. 17.47 |

| August | Rs. 20.89 | Rs. 18.17 |

| September | Rs. 21.73 | Rs. 18.89 |

| October | Rs. 21.30 | Rs. 18.52 |

| November | Rs. 21.94 | Rs. 19.08 |

| December | Rs. 22.49 | Rs. 19.56 |

The share price target for 2024 indicates a stable upward trend, suggesting a good return on investment for those looking to invest in Yes Bank stock.

Yes Bank Stock Prediction 2025

| Month | Maximum Target | Minimum Target |

|---|---|---|

| January | Rs. 22.94 | Rs. 17.65 |

| February | Rs. 23.53 | Rs. 18.10 |

| March | Rs. 24.45 | Rs. 18.80 |

| April | Rs. 23.97 | Rs. 18.44 |

| May | Rs. 23.27 | Rs. 17.90 |

| June | Rs. 24.31 | Rs. 18.70 |

| July | Rs. 23.84 | Rs. 18.34 |

| August | Rs. 24.58 | Rs. 18.90 |

| September | Rs. 25.44 | Rs. 19.57 |

| October | Rs. 26.10 | Rs. 20.07 |

| November | Rs. 26.75 | Rs. 20.58 |

| December | Rs. 27.42 | Rs. 21.09 |

The Yes Bank stock prediction for 2025 shows a positive trajectory, with the maximum target reaching Rs. 27.42 and the minimum target at Rs. 21.09. This suggests that Yes Bank stock is likely to perform well, offering good returns to its investors.

Future Predictions (2026-2030)

| Year | Maximum Target | Minimum Target |

|---|---|---|

| 2026 | Rs. 28.79 | Rs. 20.15 |

| 2027 | Rs. 31.67 | Rs. 22.17 |

| 2028 | Rs. 44.33 | Rs. 22.17 |

| 2029 | Rs. 38.39 | Rs. 19.19 |

| 2030 | Rs. 49.90 | Rs. 34.93 |

The predictions for Yes Bank stock from 2026 to 2030 indicate a consistent upward trend, with significant growth expected by 2030.

Factors Influencing Yes Bank Stock Prediction 2025

Financial Health and Performance: Yes Bank Stock Prediction 2025

Yes Bank’s improved financial health, with increased net profit and reduced NPA ratio, is a positive indicator for its stock performance. Investors should monitor the bank’s quarterly financial results to stay updated on its performance.

Regulatory Developments: Yes Bank Stock Prediction 2025

The Reserve Bank of India’s intervention in 2020 stabilized Yes Bank, and future regulatory changes could impact its stock price. Investors should keep an eye on regulatory announcements and compliance updates.

Market Sentiment: Yes Bank Stock Prediction 2025

Market sentiment plays a crucial role in stock price movements. Positive news, such as new product launches, partnerships, or improvements in digital accessibility, can boost investor confidence and drive up the stock price.

Economic Conditions: Yes Bank Stock Prediction 2025

Macroeconomic factors, such as interest rates, inflation, and GDP growth, can influence Yes Bank’s stock price. A stable economic environment is likely to support the bank’s growth and positively impact its stock performance.

Analysis and Recommendations For Yes Bank Stock Prediction 2025

Strengths: Yes Bank Stock Prediction 2025

- Strong Financial Recovery: Yes Bank’s recent financial results show a significant recovery, with increased net profit and reduced NPAs.

- Digital Initiatives: The bank’s focus on digital accessibility and new product launches, such as the SmartFin platform, enhance its service offerings and customer reach.

- Regulatory Support: The RBI’s intervention has provided stability, and positive regulatory developments could further support the bank’s growth.

Weaknesses: Yes Bank Stock Prediction 2025

- Past Challenges: Yes Bank’s history of financial instability and regulatory intervention might make some investors cautious.

- Volatility: The stock has been volatile, with significant price fluctuations over the past six months.

Opportunities: Yes Bank Stock Prediction 2025

- Market Expansion: Yes Bank’s efforts to expand its digital and retail banking services present growth opportunities.

- New Partnerships: Collaborations with other financial institutions and technology providers can enhance its offerings and drive growth.

Threats: Yes Bank Stock Prediction 2025

- Economic Uncertainty: Macroeconomic challenges, such as inflation or changes in interest rates, could impact the bank’s performance.

- Regulatory Risks: Any negative regulatory developments or non-compliance issues could affect the stock price.

Conclusion

Yes Bank stock prediction 2025 shows a promising outlook, with potential for significant returns. The bank’s financial recovery, digital initiatives, and regulatory support suggest a positive trajectory for its stock price. However, investors should remain cautious of past challenges and market volatility. For those considering investing in Yes Bank stock, it’s advisable to seek expert advice and stay updated on financial results and regulatory developments.

Call to Action

If you want to create your demat account, click the button below:

Our brand, GRM Bulls, provides all the financial services and assistance you need. If you want to learn trading, visit GRM IIT.

By carefully analyzing Yes Bank’s financial health and market conditions, investors can make informed decisions and potentially benefit from the bank’s growth in the coming years.