Rail Stocks Rally as Indian Railways Pushes for Electrification and Infrastructure Growth

The shares of companies related to the railway sector surged significantly on the BSE, showcasing a robust performance despite an overall weak market. Companies such as RailTel Corporation of India, Texmaco Rail & Engineering, IRCON International, RITES, Rail Vikas Nigam Limited (RVNL), and Titagarh Rail Systems (TRSL) saw substantial gains, rallying between 5% and 13%. This bullish trend is supported by strong growth visibility and heavy trading volumes, driven by Indian Railways’ ambitious plans for electrification and infrastructure development.

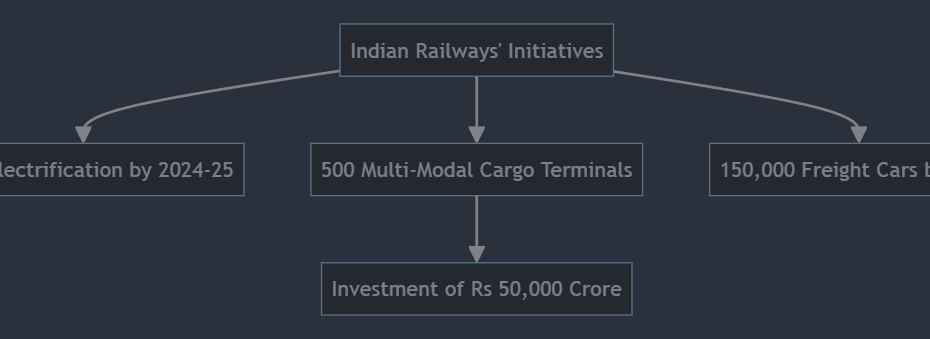

Indian Railways’ Electrification and Infrastructure Plans

Indian Railways (IR) has set an ambitious target to achieve 100% railway route electrification by 2024-25. This massive project is part of the broader ‘PM GatiShakti’ program, which aims to establish approximately 500 multi-modal cargo terminals with an estimated investment of Rs 50,000 Crore over the next four to five years. Additionally, IR plans to procure 150,000 freight cars by 2025, reflecting the government’s strong focus on infrastructure spending.

Key Initiatives and Investments

- Route Electrification: Aiming for 100% electrification by 2024-25.

- Multi-Modal Cargo Terminals: Establishing ~500 terminals under the ‘PM GatiShakti’ program.

- Freight Car Procurement: Targeting 150,000 new freight cars by 2025.

These initiatives are expected to boost the rolling stock sector, with wagon manufacturers receiving orders exceeding the total of the last decade.

RailTel Corporation of India: A Major Beneficiary

Among the individual stocks, RailTel Corporation of India experienced a remarkable 13% surge in intra-day trade on the BSE. The company announced receiving a work order from South Central Railway for telecommunication works, amounting to Rs 20.22 crore. In June alone, RailTel secured orders worth Rs 137 crore, including a significant Rs 81.45 crore contract from the National Informatics Centre Services Incorporated.

Recent Performance and Trading Volumes

- June Performance: Orders worth Rs 137 crore received.

- Stock Price: Rebounded 46% from its June 5 low of Rs 335.10 on the BSE.

- Trading Volumes: Average volumes tripled, with 41.44 million shares traded on NSE and BSE.

RailTel’s robust performance underscores the growing demand for telecommunication and ICT infrastructure in the railway sector.

Texmaco Rail & Engineering: Riding the Wave of Demand

Texmaco Rail & Engineering saw its shares rally by 8% to Rs 222.30, supported by a two-fold increase in average trading volumes. The company’s strong operational performance is driven by the Indian Railways’ fast-track approach and the government’s ‘Atmanirbhar Bharat’ initiative.

Order Book and Future Prospects

- Current Orders: Over 14,000 wagons, with consistent annual demand expected.

- Future Orders: An additional 20,000-25,000 tenders anticipated.

- Private Sector Demand: Significant growth in private wagon requirements, particularly in the cement and steel industries.

Texmaco’s strategic participation in government and private tenders positions it well to capitalize on the increasing demand for specialized wagons.

RVNL: A Robust Order Book and Strong Bidding Activity

Shares of Rail Vikas Nigam Limited (RVNL) soared by 8% to Rs 417.40, with trading volumes increasing nearly four-fold. RVNL boasts an impressive order book of Rs 85,000 crore and has actively participated in bids worth Rs 65,000 crore in FY23-24.

Key Highlights

- Order Book: Rs 85,000 crore.

- Bidding Activity: 142 bids worth Rs 65,000 crore in FY23-24; more than 150 bids expected in FY24-25.

- Success Rate: Achieved Rs 20,000 crore in successful bids.

RVNL’s proactive approach in securing high-value contracts underlines its critical role in India’s railway infrastructure development.

Conclusion

The recent rally in railway-related stocks on the BSE is a testament to the strong growth prospects and substantial government investments in the sector. Companies like RailTel Corporation of India, Texmaco Rail & Engineering, and RVNL are well-positioned to benefit from Indian Railways’ ambitious electrification and infrastructure plans. With a focus on enhancing operational efficiency and expanding infrastructure, these companies are set to play a pivotal role in India’s railway modernization journey.

Create Your Demat Account

If you want to create your demat account, click on the button below. At GRM Bulls, we provide comprehensive financial services and assistance to help you with your investments.

Learn Trading with GRM IIT

If you want to learn trading, visit GRM IIT. We offer extensive courses and resources to help you become proficient in trading and investment strategies.