What is a Demat Account ?

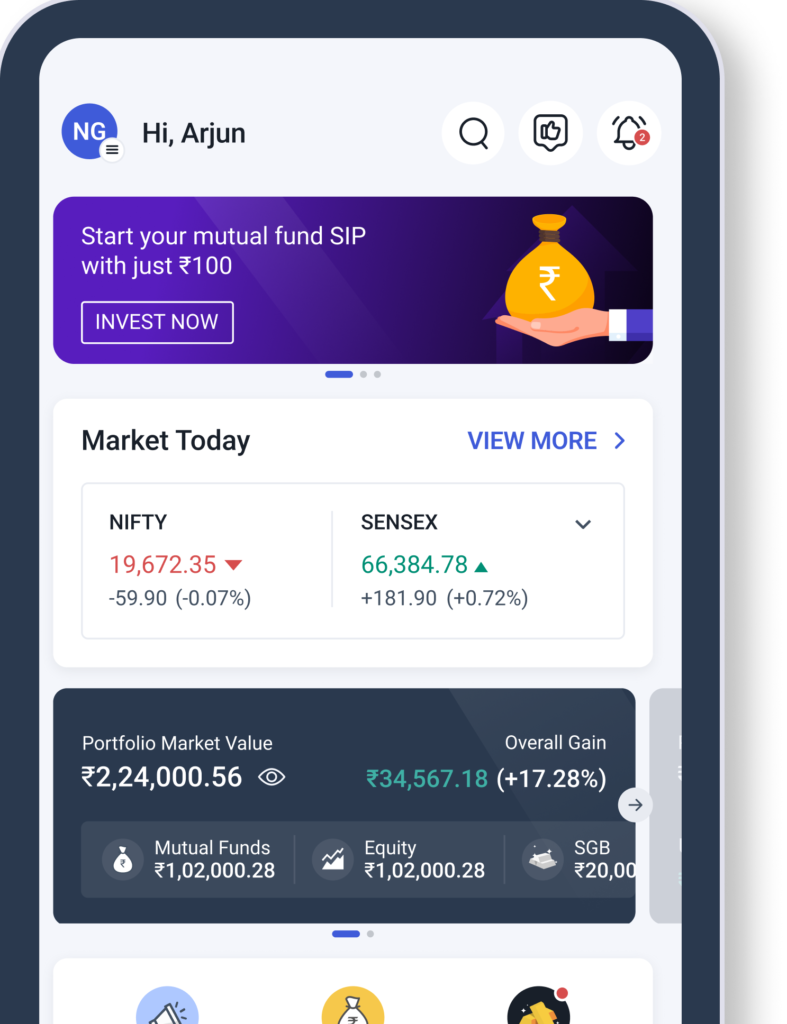

A demat account, short for dematerialized account, is an electronic account used to hold securities such as stocks, bonds, mutual funds, exchange-traded funds (ETFs), government securities, and other financial instruments in electronic form. In essence, a demat account functions as a digital repository for your investments, replacing the traditional method of holding physical share certificates.

Key Benefits of Demat Account:

- Convenience: Say goodbye to the hassles of physical paperwork and manual processes. With a demat account, you can buy, sell, and transfer securities seamlessly with just a few clicks, anytime and anywhere.

- Security: Rest assured knowing that your investments are safe and secure in electronic form. Demat accounts offer robust encryption and authentication measures to safeguard your assets against loss, theft, or damage.

- Efficiency: Enjoy swift and efficient transactions with real-time updates and notifications. Monitor your portfolio’s performance, track market trends, and receive timely alerts on corporate actions, all from a single platform.

- Diversification: Access a wide range of investment options, from stocks and bonds to mutual funds and ETFs. Diversify your portfolio effortlessly and explore new opportunities for growth and wealth creation.

- Cost Savings: By eliminating the need for physical paperwork and storage, demat accounts help reduce administrative costs and paperwork, allowing you to focus on maximizing your returns.

PROCESS

How to Open Free Demat Account?

EXPLORE

Investment Options

Stocks

F&O

IntraDay Trading

Mutual Funds

Commodities

Debt Market/Bonds

IPO

US Stocks

ETF

BENEFITS

Why Open Demat Account With ANGEL ONE

0

+

Support Given

0

+

Clients Rating

0

M +

Money Saved

0

+